Merchant Cash Advance (also known as Business Cash Advance)

The team at Goodman Corporate Finance is able to offer a simple alternative to the traditional bank loan with our business cash advance service.

What is a Merchant Cash Advance?

Many lenders can offer your business access to a Merchant Cash Advance (MCA). This form of business finance serves as an alternative funding option to traditional bank loans. An MCA provider will source your business an upfront sum of cash in an exchange for part of your future sales.

This financing option is valuable for small-to-medium-sized businesses that need some extra money. This can help with cash flow requirements and business growth at the early stages.

Different lenders have varying offers when it comes to granting Merchant Cash Advances – for example, one of our panel members 365 Business Finance, offers Merchant Cash Advances between £10,000 to £300,000 in funding.

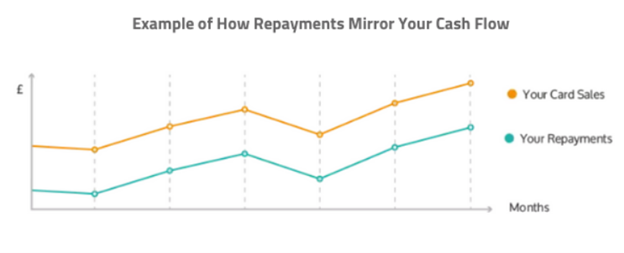

Unlike a traditional bank loan, Merchant Cash Advances come with no interest rates or fixed monthly payments. Repayments come out of your business’s future credit/debit card payments. Repayments, therefore, reflect the ups and downs of your business’s cash flow. In quiet periods it means you can repay less. As such, for many UK businesses, a Merchant Cash Advance was an ideal source of finance throughout the Covid-19 pandemic as business owners didn’t have to stress about repayments during lockdowns and uncertain trading periods.

Merchant Cash Advances act as a quick loan and an immediate injection of cash into businesses – it eradicates long processing times and is ideal for small businesses. Merchant Cash Advances are a form of unsecured finance – this means that no security is needed in the form of a tangible asset to access funding. This eradicates long processing times, and means your funding application can be approved within 24 hours.

Eligibility:

Eligibility for Merchant Cash Advances does depend on the lender, but with 365 Business Finance, your business ideally will process £10,000 per month in credit and debit card sales. Repayments are automatic and deducted as a small percentage of your future card sales. Furthermore, your business must have been trading for a minimum of 6 months.

Benefits of MCAs:

- This type of financing is unsecured

- Affordable and flexible as an alternative to a traditional bank loan

- A great option for short-term finance

- 90% approval rating from 365 Business Finance

- Approval within 24 hours

- No interest rates, APRs, or fixed payments

- No late penalties or hidden fees – you can agree on one, upfront cost that never changes

- Repayments are flexible and based on your card sales

- No business plan required

- Bad credit or poor credit history isn’t a barrier to receiving funding

- Short repayment period – 5 to 10 months

- Repayments are automatic and simple

Bank Loans vs Merchant Cash Advances:

- Successful businesses within the hospitality sector are leveraging merchant cash advances instead of traditional bank loans to get back on their feet after the pandemic

- With MCAs there are no interest rates or fixed monthly payments to worry about

- With an MCA, repayments mirror the ups and downs of your business, easing financial stress and burden

- Unlike traditional bank loans, there are no APRs with an MCA- instead, there’s just one all-inclusive cost that’s agreed on at the start, which never changes

- Terms aren’t as restrictive as bank loans

- Bank loans can be a lengthy and challenging process, while an MCA can provide immediate injection of cash into a business – this is good for high-risk businesses, especially those within hospitality

365 Business Finance has helped provide thousands of business owners with an affordable way to fix cash flow issues and improve growth and development. Check these frequently asked questions to find out more.

If a Merchant Cash Advance sounds like the right option for your business, get in touch today and one of our expert brokers will connect you with the perfect lender to match your business requirements.

By Elicia Boni – Digital Marketing and Content Executive

If you are interested in learning more about Goodman’s bespoke broker services and how we can help your specific financial needs, then you can click on the relevant links: Asset Finance, Corporate Finance Services, Invoice Finance, or Property Finance.

Already have an idea of what type of financing you require? Don’t hesitate to get in touch. Contact us here or call us now on 0333 3583502 for a free consultation with one of our expert corporate finance specialists.

Allow your business to survive and thrive! Get in touch today