Multi-product Lender

Product guide:

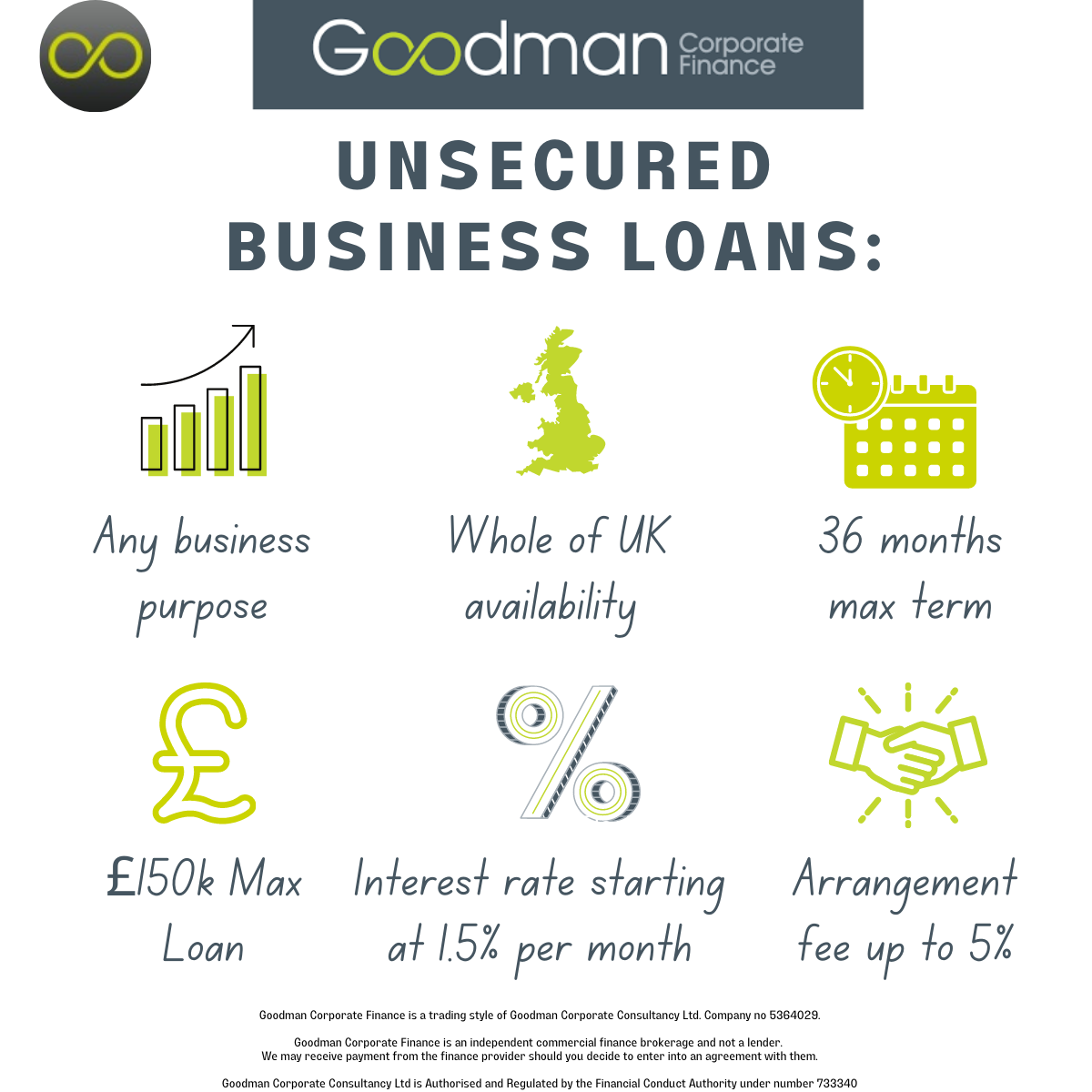

- Unsecured Business Loans up to 150k

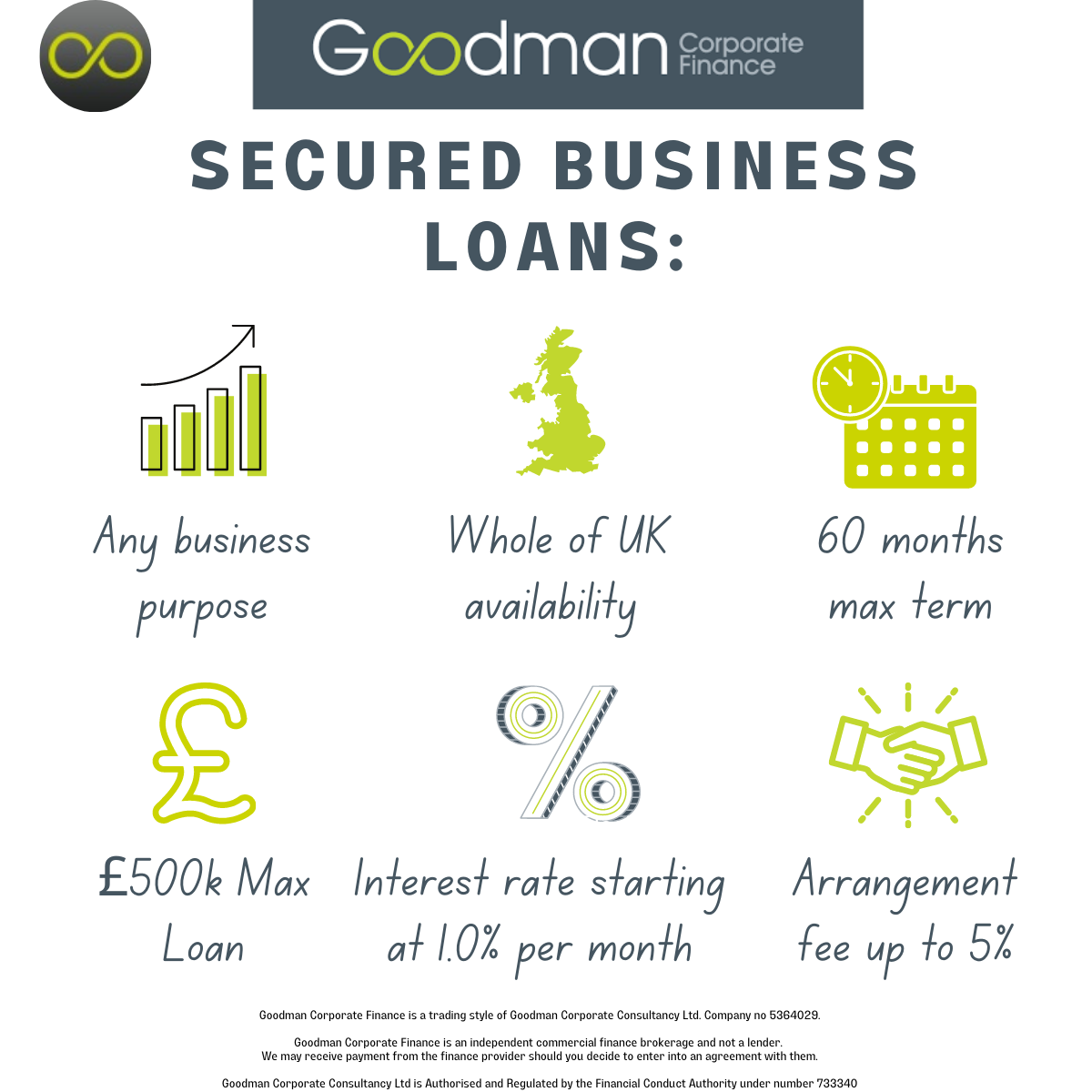

- Secured business loans up to 500k

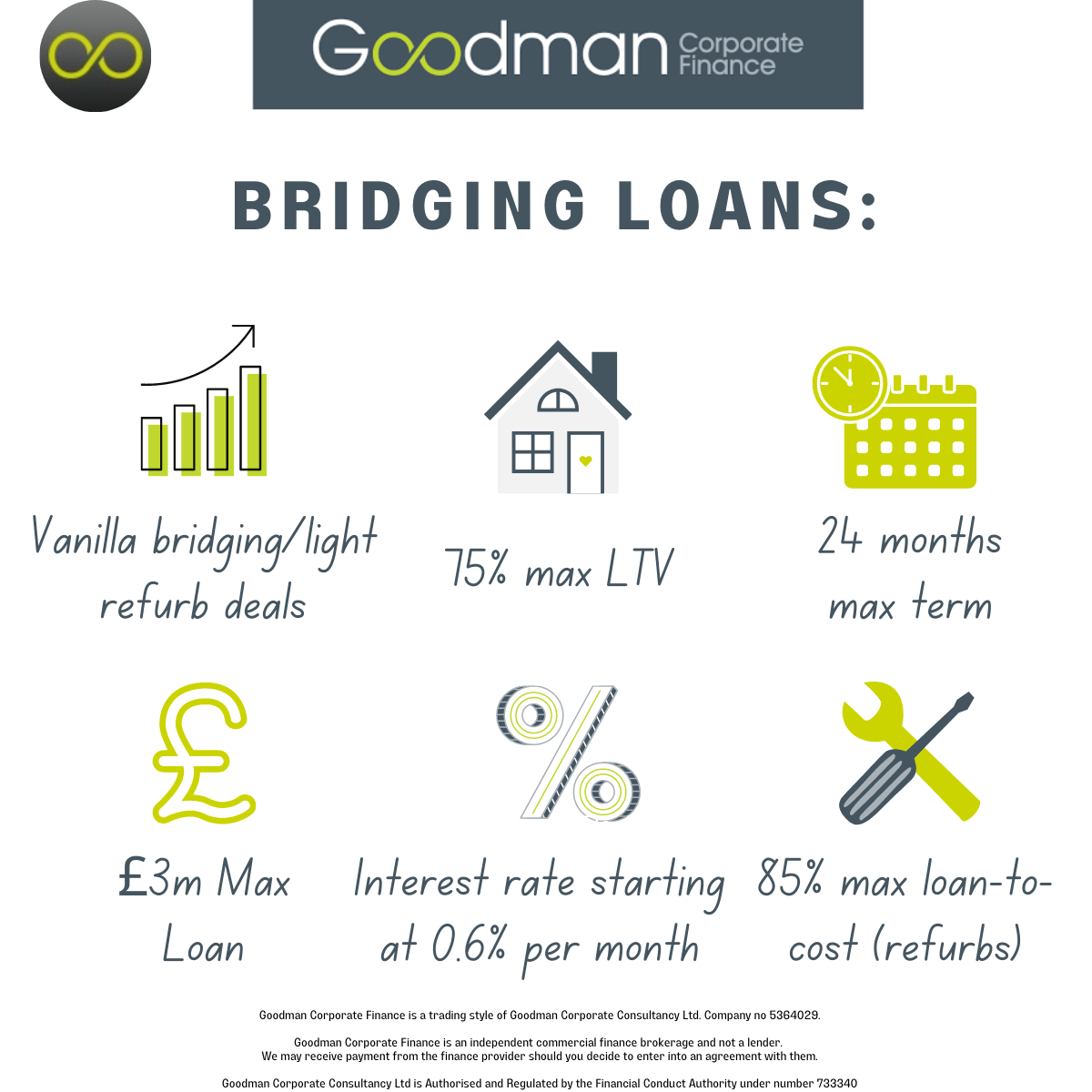

- Bridging loans up to £3m

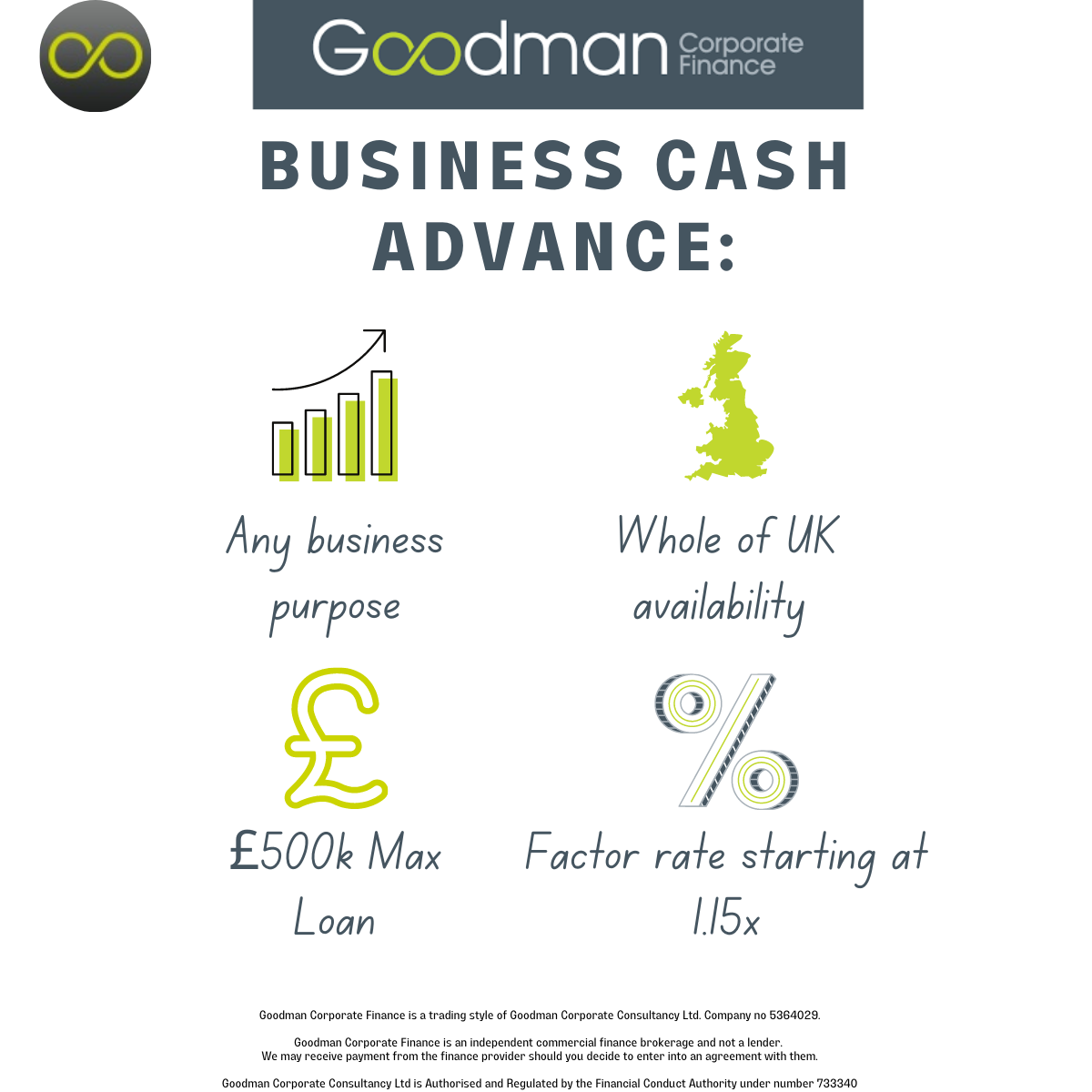

- Business Cash advance up to £500k

- Recovery Loan Scheme (RLS)

Introduction:

The lender launched in 2013 with the mission of ensuring its clients enjoy clarity and confidence to realise their potential. They are also a patron of the NACFB. They focus on businesses of all sizes and in all sectors. Listen to their offering to find out if this can add value to YOUR business – if they can then fill in one of our contact forms here.

Believing that ‘communication is king’, this lender recognises that the demand for flexible and tailored finance will inevitably increase post-pandemic. Ongoing support is crucial to UK SMEs and the need for a strong client-lender relationship is key.

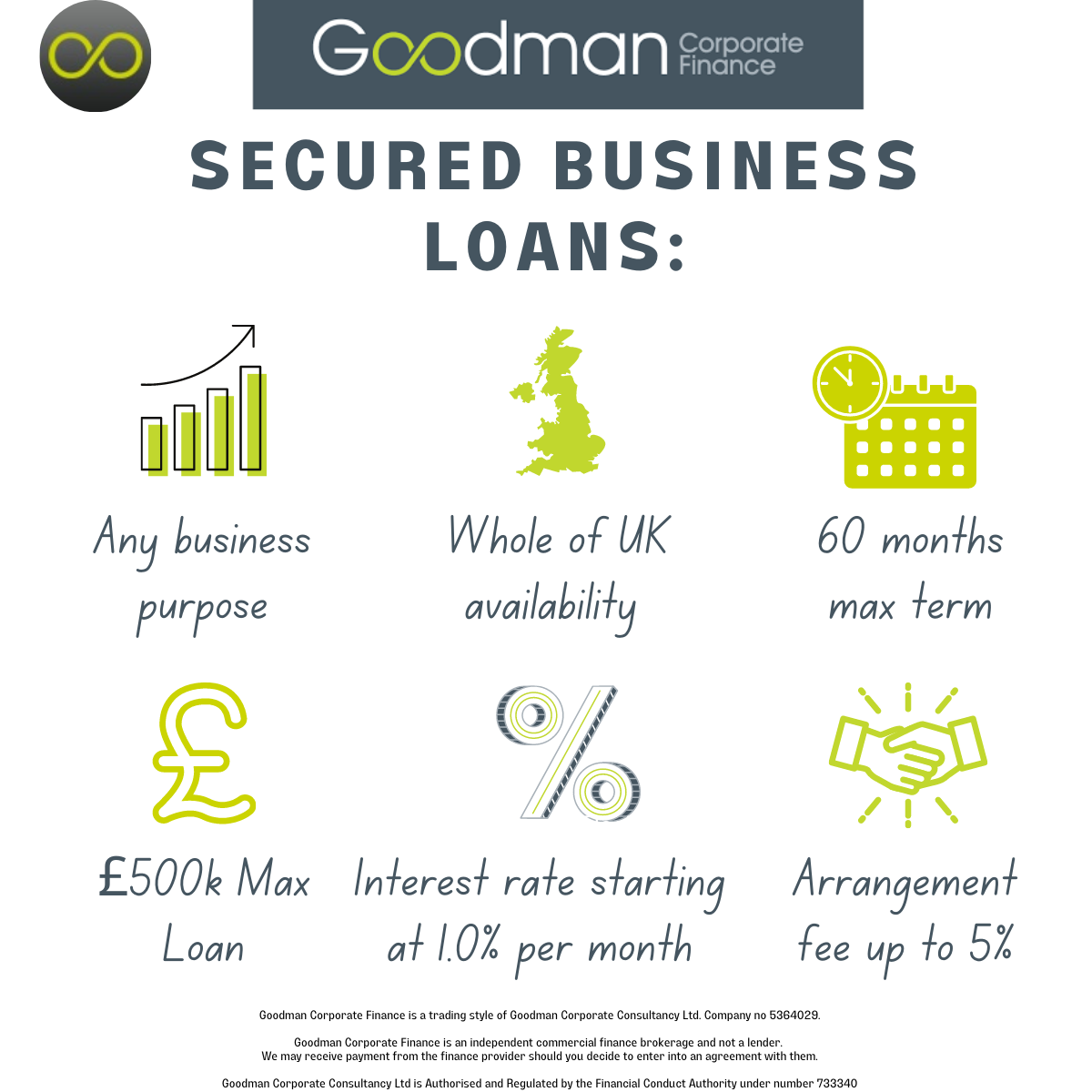

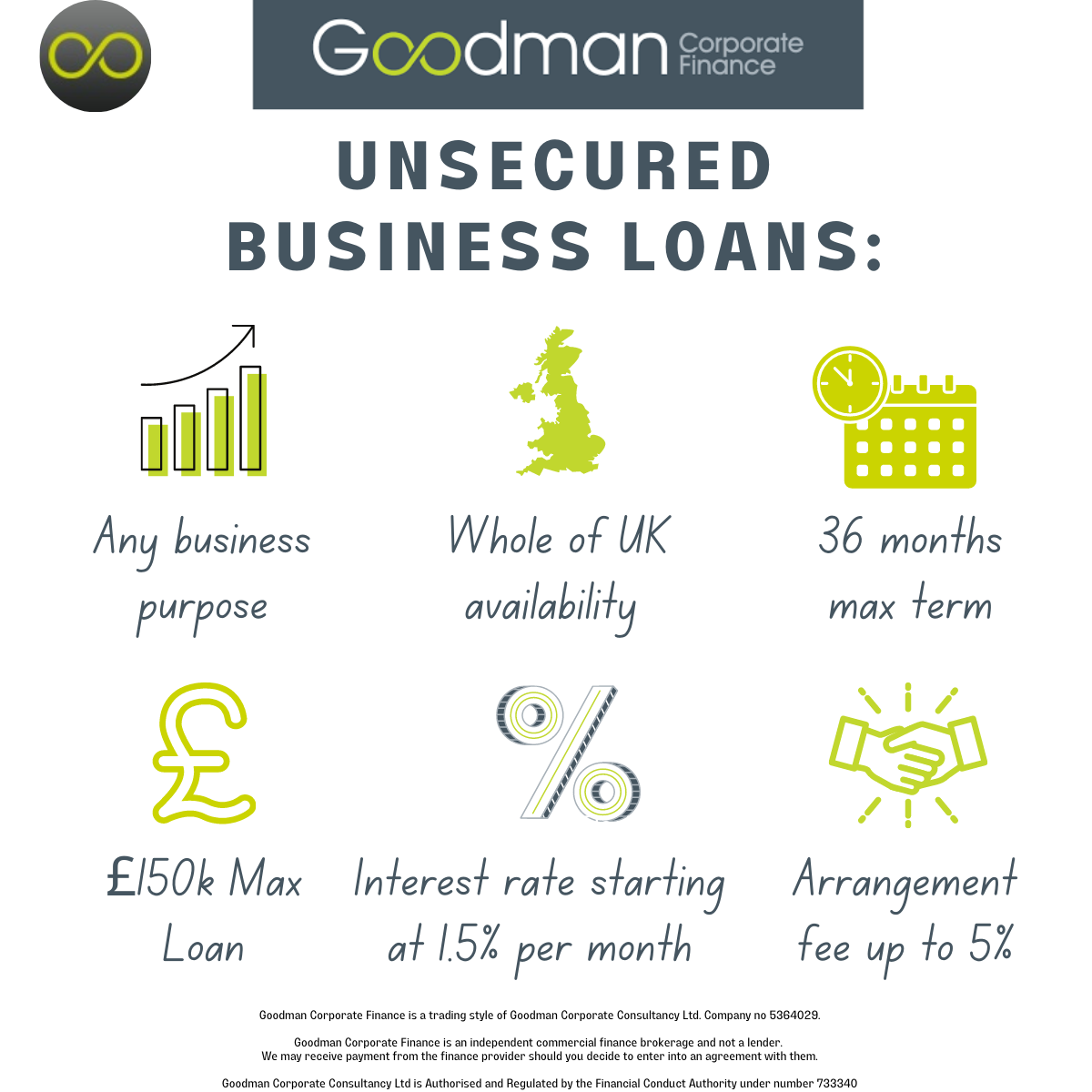

Unsecured and Secured Business Loans:

This lender can offer funding to businesses that:

- Are UK based and generate more than 50% of turnover from trading activity

- Are using the facility to support trading primarily in the UK and for business purposes only (working capital, expansion or debt refinance)

- Meet the following criteria: Minimum turnover of £200k per annum, Minimum of one year’s filed financial accounts, One of the shareholders is a homeowner

- For applications >£250k: security is available – Limited company, LLP, sole trader or partnership – Any CCJs are settled/in process of being settled

|

|

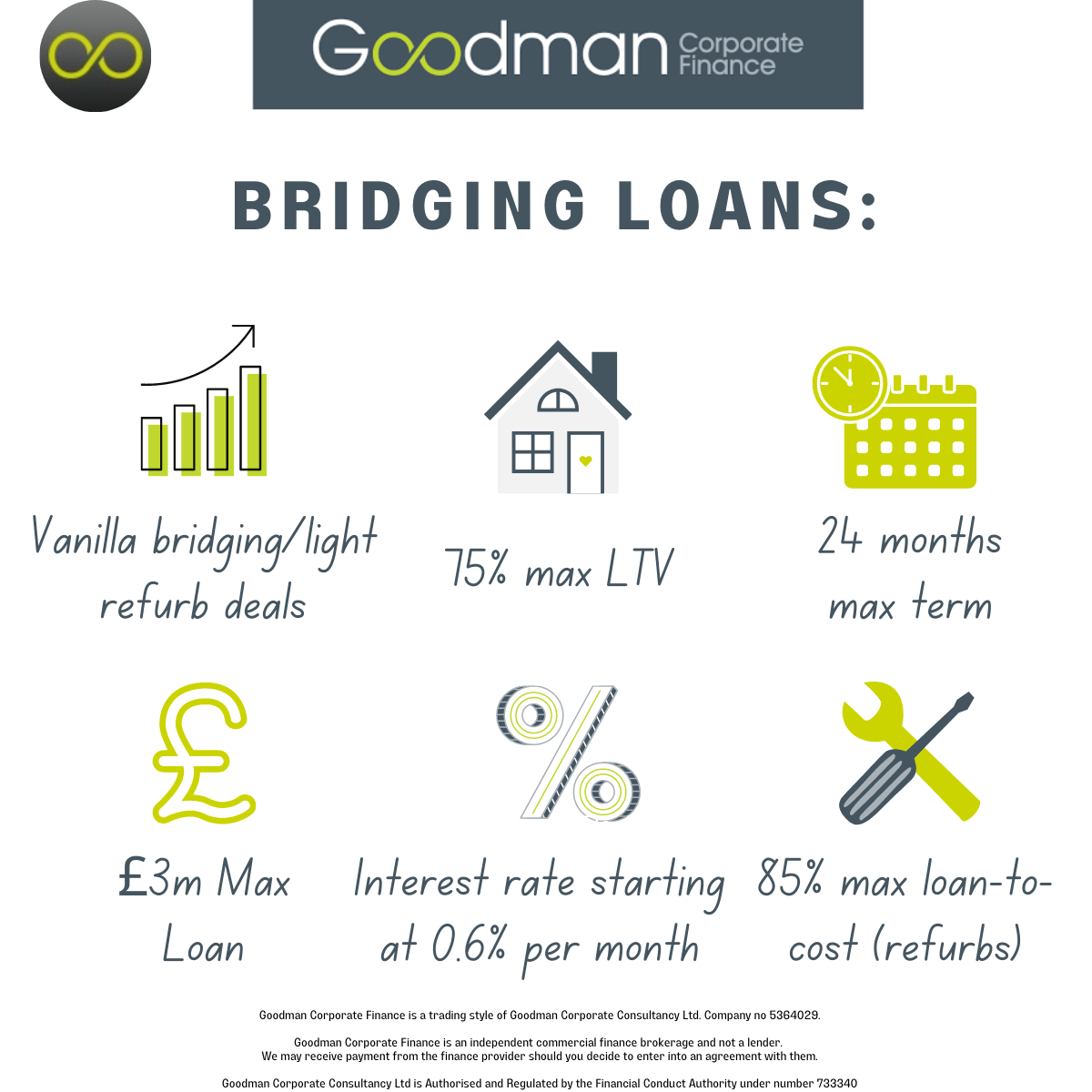

Bridging Loans:

Your business can be eligible for one of these Bridging Loans if the property securing the Loan is not in fully finished condition (e.g. Development Exit, Conversions and Light Refurbishment Loans), or, if the Property requires only light, non structural works until reaching a habitable condition.

Examples of deals completed:

- Development exit funding of £500,000 provided to support a developer experiencing delays due to Covid-19 with the sales of seven flats constructed close to Aberdeen. (12 month term, no exit/settlement fees, 5 week turnaround, now fully repaid)

- Development exit loan of £500,000 provided to a property development company to allow additional time to market and completion of sales on a three house development in Oxford, which was impacted by building delays during the pandemic. (15 month term, no exit/settlement fees, 2 week turnaround, now fully repaid)

|

|

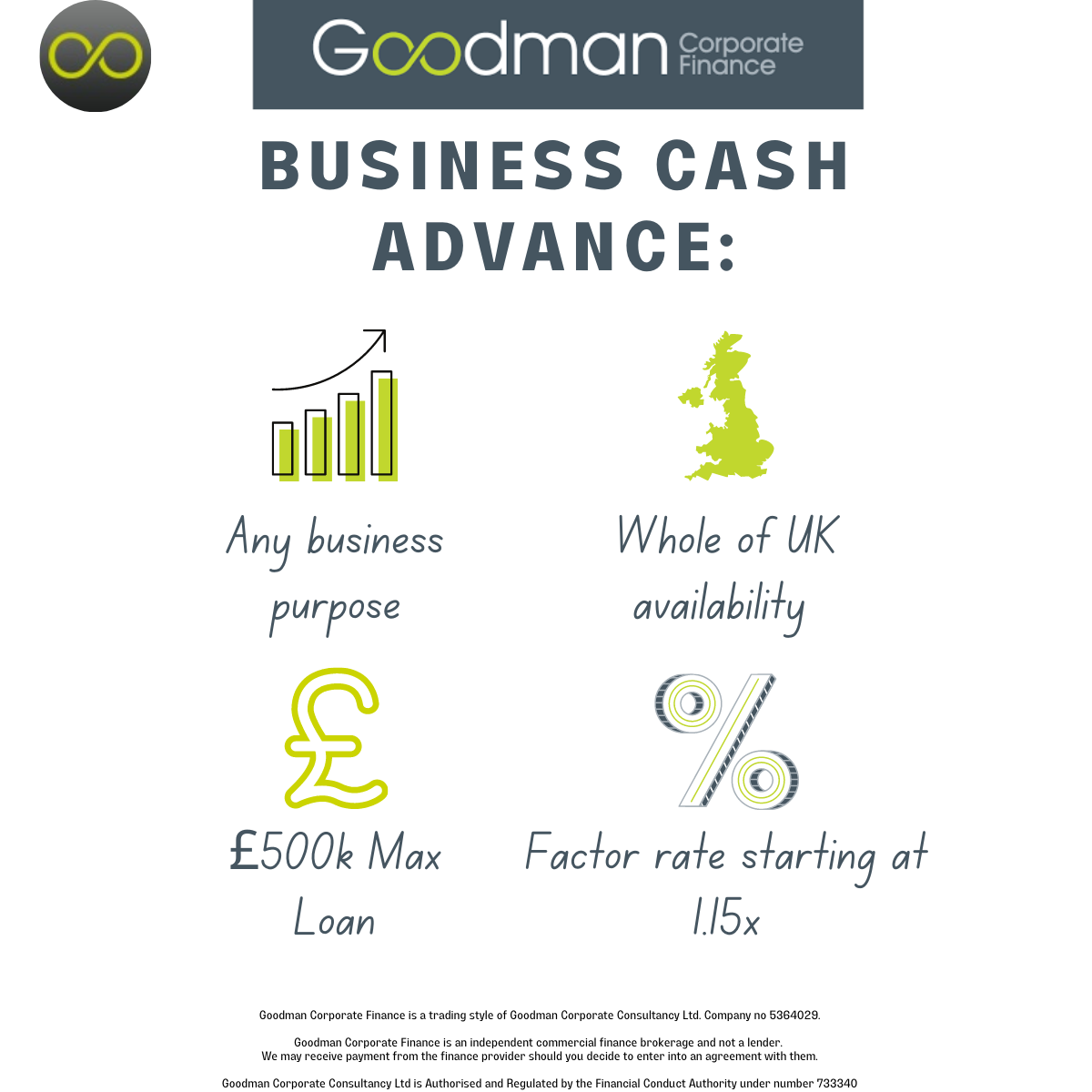

Business Cash Advance:

You can be eligible if:

- A Limited company, sole trader or partnership

- Company is UK registered (excl. Jersey and Isle of Man)

- Minimum of 6 months of trading history

- Minimum of £5,000 per month through card terminals

- Any CCJs are settled or in the process of being settled

- Personal guarantee is also available

|

|

RLS Business Loans:

RLS funding may be available to businesses that:

- Have been adversely impacted by COVID-19

- Are UK based and generate more than 50% of its turnover from trading activity

- Are using the facility to support trading primarily in the UK and for business purposes only (working capital, expansion or debt refinance)

- Meet the following criteria: Minimum turnover of £200k per annum, Minimum of one year’s filed financial accounts, One of the shareholders is a homeowner,

- For applications >£250k: security is available – Limited company or LLP – Any CCJs are settled/in process of being settled

|

|

Why work with this lender?

- Highly experienced property team that includes the former UK Head of property finance for Barclays Business Bank, Funding Circle & BAWAG PSK Investment Bank.

- 24-hour turn around to indicative ‘heads of terms’ from the time a lead is received.

- We’re focused on smaller transactions that get de-prioritised by other lenders.

- No structured application form or broker portal – send deals through as you would like to package them.

- An especially commercial and bespoke approach to underwriting deals.

- Ensuring that the Recovery Loan Scheme is used as intended to support UK SME property developers.

If these above products would add value to your business, get in touch today!

By Elicia Boni – Digital Marketing and Content Executive

If you are interested in learning more about Goodman’s bespoke broker services and how we can help your specific finance needs, then you can click on the relevant links: Asset Finance, Corporate Finance Services, invoice finance, or Property Finance.

Already have an idea of what type of financing you require? Don’t hesitate to get in touch. Contact us here or call us now on 0333 3583502 for a free consultation with one of our expert corporate finance specialists.

Allow your business to survive and thrive! Get in touch today.