What is Trade Finance?

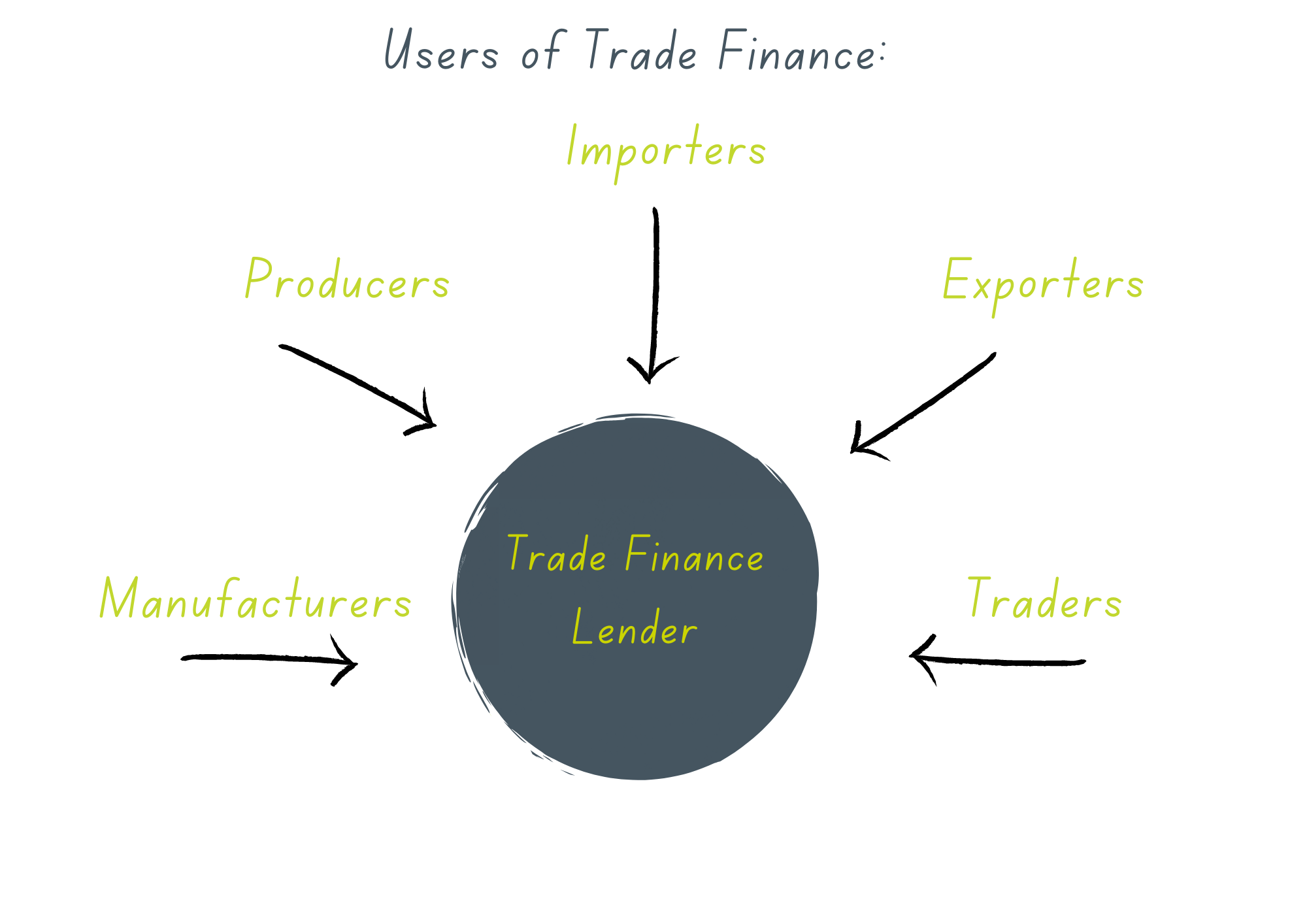

Trade finance refers to a type of financial product use by companies when it comes to the export, import, and trading of goods. Trade finance is an umbrella term that can refer to many types of financial service.

An exporter may need an importer to prepay for goods that are shipped. It is in the importer’s interests to reduce the financial risk of this transaction. This is where a lender can come in to help with risk mitigation. Trade finance can provide the exporter with receivables or payment according to an agreement, the importer is also able to extend credit to fulfil the trade order.

For risk mitigation the following things are required:

- The financier to have control over the use of funds control of goods, and source of repayment

- Monitoring of the trade cycle through the transaction process

- Security over the goods and receivables

Exporters typically prefer upfront payment for shipments to avoid the potential risk of the importer taking the shipment but refusing to pay for the goods, on the other hand, if the importer does pau up front then the exporter may accept the payment but not ship the goods. A solution can be for the importer’s funder to provide a letter of credit to the exporter’s funder, this will provide the payment once the exporter has presented documents for proof of shipment. This letter of credit guarantees that once there is proof of shipment then payment will be made.

Benefits of Trade Finance:

- Trade finance helps importers and exporters build trust in dealing with each other

- Risk mitigation is provided by a third-party (the funder)

- Improves cash flow and operations efficiency

- Fewer payment delays

Why choose Goodman Corporate Finance?

We will manage the whole deal for you, from the moment you make the enquiry right up to the point where the funds have been released. With our handheld and cradle to grave service, we pride ourselves on putting you and your business first, with expert guidance. This process takes the time and confusion out of sourcing the perfect funder.

We approach every new opportunity with ‘a blank sheet of paper’, offering a number of solutions for you to choose from. This unique approach means that you can choose the right solution for your situation.