Multi-product Lender

This blog piece showcases a multi-product selection offered by one of our lender’s as an example of the types of deals we can access.

Speak to a finance expert today - 0333 3583502

This blog piece showcases a multi-product selection offered by one of our lender’s as an example of the types of deals we can access.

We are pleased to announce the onboarding of TradePlus24 onto our esteemed panel of over 280 funders.

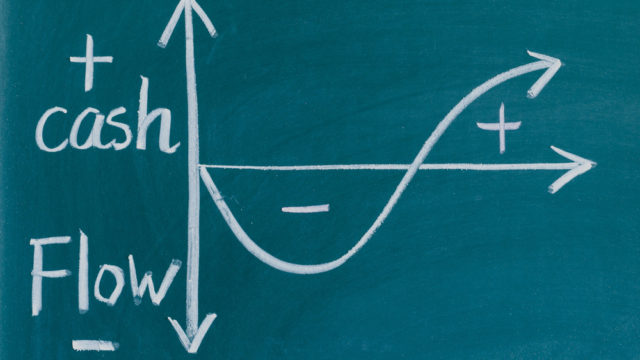

A 2021 educational update of the popular funding option that can suit your business!

The UK’s Small Business funding gap is estimated between £25-50 billion for its 5.2m SMEs and the Bank Rejection rate for SMEs is 50%.

With the demise of the traditional bank funding, invoice finance and working capital facilities can complement your existing bank facilities.

If you need fast access to cash, you need one of our short term business finance solutions.

If you need quick cash to meet your immediate business needs, factoring could be exactly the solution you’re looking for.

If you need to fund your business, you have many solutions to choose from. Your challenge isn’t so much finding a funding solution as deciding which one is right for you.

When it comes to business financing, bank loans and overdrafts are not necessarily your best option. Factoring is an alternative solution that allows your business to finance itself using its own assets.

Invoice factoring is a financial transaction in which a business sells its invoices to a third party at a discount. It’s a strategy that’s long been recognised as vital to the success of SMEs, particularly in those crucial early days of business.